If you’re a vehicle owner in Ireland, you’ll want to know how to perform a car tax check to ensure your vehicle is appropriately taxed. Understanding the car tax system and how it works is crucial for staying on the right side of the law in Ireland and avoiding fines or penalties. In this comprehensive guide, we’ll walk you through the process of how to check if a car is taxed, explain the various car tax bands in Ireland, and provide you with valuable insights on ensuring your vehicle is properly taxed. Plus, if you’re also looking for the right car insurance to protect your vehicle and finances, Insuremycars.ie is here to assist you. Whether you’re a new car owner or simply need a refresher, we’ve got you covered.

The Basics of Car Tax in Ireland

Before we delve into the details of how to check your motor tax in Ireland, let’s start with the basics. Car tax, also known as motor tax, is a legal requirement for all roadworthy vehicles in Ireland. The revenue generated from car tax goes towards maintaining and improving the country’s road infrastructure. It’s an essential part of vehicle ownership and ensures that the roads you drive on are safe and well-maintained.

When it comes to paying your motor tax, you’ve got several choices. You can handle it online, make a trip to your local motor tax office, or opt for the traditional method of postal forms. Typically, you’ll receive a tax disc for a duration of 3, 6, or 12 months. The specific cost varies based on your vehicle type.

How Is Car Tax Calculated in Ireland?

Motor tax is determined by three key assessments, depending on your vehicle’s specifications:

Engine Size

If your vehicle was manufactured before July 2008, the motor tax calculation is primarily based on the size of your vehicle’s engine. Vehicles with larger engines generally incur higher motor tax rates.

CO2 Emissions (NEDC)

For vehicles registered between 1st July 2008 and 31st December 2020, motor tax is calculated based on the vehicle’s CO2 emissions using the New European Driving Cycle (NEDC) measurement. The amount you pay correlates with your vehicle’s emissions level.

CO2 Emissions (WLTP)

If your car was registered after January 1st, 2021, motor tax is calculated using the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) values for CO2 emissions. The tax rate is determined by your vehicle’s emissions in this case.

How to Check My Car Tax in Ireland

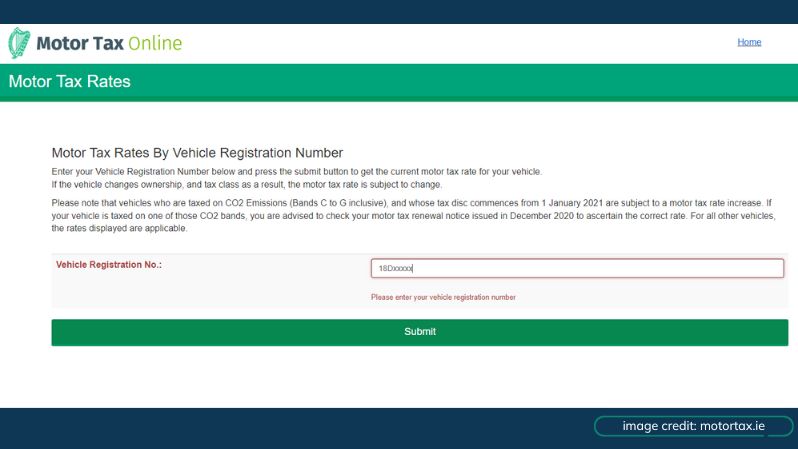

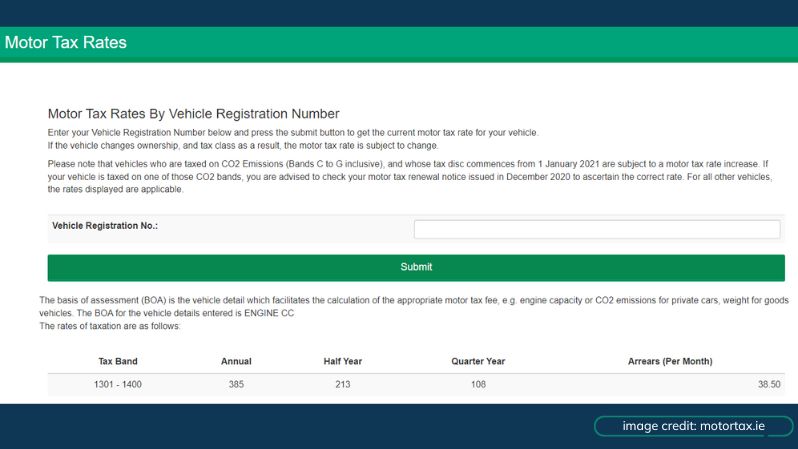

To get a clear idea of which band your car falls into and to check the amount of tax you owe, you can use the useful online tool from Motortax.ie. Here’s a step-by-step guide on how to do it:

- Visit Motortax.ie.

- Navigate to the motor tax section.

- Look for the “Motor Tax Rates” dropdown on the right-hand side.

- Click “By Vehicle Registration Number” from the list of options to search from.

- Enter your vehicle registration number to check your car tax amount.

It’s a straightforward process that provides you with the precise amount of tax you owe for your car.

Understanding Car Tax Bands in Ireland

Tax in Ireland is not a one-size-fits-all fee. It varies based on several factors, including the type of vehicle you own and its emissions. These factors determine which car tax band your vehicle falls into. The Irish government uses a band system to categorise vehicles, with each band corresponding to a specific amount of tax.

In Ireland, motor tax for private vehicles is calculated based on various criteria depending on when the vehicle was first registered. Here’s a breakdown of how motor tax is determined:

Vehicles Registered Before 1st January 2008

For private vehicles first registered before the 1st of January 2008, motor tax is calculated based on the engine size of the vehicle. Here are the rates of duty for this category:

| Engine Size (cc) | Tax Per Year |

| 1,200 or under | €199 – €330 |

| 1,201 – 1,600 | €358 – €514 |

| 1,601 – 2,000 | €544 – €710 |

| 2,001 – 2,400 | €906 – €1,304 |

| 2,401 – 2,800 | €1,080 – €1,391 |

| 2,801 – 3,000 | €1,443 – €1,494 |

| 3,001 or more | €1,809 |

Vehicles Registered Between 1st July 2008 and 31st December 2020

Private vehicles registered in Ireland during this timeframe have their motor tax determined by the vehicle’s CO2 emission levels, based on the NEDC value. Here are the rates of duty for this category:

| Tax Band | CO2 Emissions Per km | Tax Per Year |

| A | 0 | €120 |

| A1 | 1-80g | €170 |

| A2 | 80-100g | €180 |

| A3 | 100-110g | €190 |

| A4 | 110-120g | €200 |

| B1 | 120-130g | €270 |

| B2 | 130-140g | €280 |

| C | 140-155g | €400 |

| D | 155-170g | €600 |

| E | 170-190g | €790 |

| F | 190-225g | €1,250 |

| G | 225g+ | €2,400 |

Vehicles Registered on or After 1st January 2021

For private vehicles first registered in Ireland on or after the 1st of January 2021, motor tax is calculated based on the vehicle’s CO2 emission levels, using the WLTP value. Here are the rates of duty for this category:

| Tax Band | CO2 Emissions Per km | Tax Per Year |

| A | 0 | €120 |

| A1 | 1-50g | €140 |

| A2 | 50-80g | €150 |

| A3 | 80-90g | €160 |

| A4 | 90-100g | €170 |

| A5 | 100-110g | €180 |

| A6 | 110-120g | €190 |

| B1 | 120-130g | €200 |

| B2 | 130-140g | €210 |

| C1 | 140-150g | €270 |

| C2 | 150-160g | €280 |

| D | 160-170g | €420 |

| E | 170-190g | €600 |

| F1 | 190-200g | €790 |

| F2 | 200-225g | €1,250 |

| G | 225g+ | €2,400 |

Imported Vehicles

If you have a private vehicle that was originally registered abroad and has been imported into Ireland, specific tax rules apply. You can find further information here.

Understanding and checking these motor tax bands is essential to ensure you’re paying the correct amount of tax for your vehicle, keeping you in compliance with Irish tax regulations.

Electric Vehicles

Electric vehicles fall into the lowest tax category. That means, if you own a hydrogen or electric vehicle with zero emissions the cost of tax will fall under the standard rate of €120 per year. Want to know more about how you could save money going fully electric? Then, click here to learn more about why you should buy an electric car!

Check My Motor Tax Ireland: An Ongoing Responsibility

Once you’ve checked and determined your motor tax amount and ensured that your vehicle is properly taxed in Ireland, your responsibilities don’t end there. Car tax is an ongoing requirement, and it’s essential to renew it regularly. Just like driving without a valid licence is an offence, so is driving your car without tax. Failure to do so can result in a fixed charge fine of €150. The Gardaí also have the power to impound your vehicle.

In cases where you’ve misplaced your driver’s license, it’s essential to know what steps to take. Check out our blog on what to do if you’ve lost your driving licence to ensure you’re prepared for such situations.

Checking and managing your car tax in Ireland is an essential part of responsible vehicle ownership. By regularly checking your motor tax amount, ensuring your vehicle is properly taxed, and staying informed about tax bands, you can navigate the world of car taxation in Ireland with confidence.

At Insuremycars.ie, we understand that financial responsibilities like car tax are part of life. We specialise in providing you with the right car insurance tailored to your unique needs. Visit our website today to explore our range of car insurance options, and let us be your trusted partner in safeguarding your vehicle on Irish roads.