If you’re a classic car owner in Ireland, understanding how classic car tax works can help you save money and keep your vehicle on the road. As a leading broker for classic car insurance in Ireland, we understand the unique needs of vintage vehicle enthusiasts. In this guide, we’ll cover the ins and outs of classic car tax in Ireland and provide you with practical steps for managing your car’s tax status.

What Defines a Classic Car?

In Ireland, a classic car is typically defined as a vehicle that is more than 30 years old. This classification is important because it allows owners of older vehicles to benefit from a reduced tax rate. Classic cars are celebrated for their historical significance and unique design, which is why the government offers incentives to help maintain these cherished vehicles.

Classic Car Tax in Ireland: Key Details

Classic car tax in Ireland is a significant benefit for vintage vehicle enthusiasts. As of the latest rates, the tax for classic cars is set at a reduced fee of €56 per year. This is a notable saving compared to the standard road tax, which can be considerably higher depending on the vehicle’s CO2 emissions and engine size.

To qualify for the classic car tax rate, your vehicle must:

- Be over 30 years old.

- Be used primarily for recreational purposes and not for commercial use.

This reduced tax rate is designed to make it easier for classic car owners to preserve and enjoy their vehicles while keeping costs manageable.

Vintage Car Tax in Ireland: Understanding the Terminology

When discussing classic tax in Ireland, you might come across terms like “vintage car tax” and “classic tax.” Although these terms are often used interchangeably, they generally refer to similar tax benefits for older vehicles. According to the Irish Veteran & Vintage Car Club (IVVCC), the classification of vehicles based on their age is as follows:

- Before 1918: Veteran

- 1919-1930: Vintage

- 1931-1945: Post-Vintage

- 1946-1994: Classic

For tax purposes, both vintage and classic cars benefit from the same reduced rates in Ireland. Vintage tax in Ireland typically refers to the tax benefits applied to cars that fall into these older categories. While you may hear terms like “vintage car tax” or “vintage car insurance,” the actual Irish tax rates remain consistent with those applied to classic cars.

Vintage Tax and classic car tax in Ireland both offer reduced rates to support the preservation of historically significant vehicles. Whether your vehicle is classified as vintage or classic, you will generally pay the same reduced tax rate. This helps ensure that these cherished vehicles can remain on the road without imposing a heavy financial burden on their owners.

The Benefits of Owning a Classic Car

Owning a classic car comes with several financial benefits, thanks to the reduced tax rate. Here are some of the advantages:

1. Lower Costs

The reduced tax rate of €56 per year means significant savings compared to standard road tax rates.

2. Preservation of History

Classic cars encourage the preservation of historical vehicles, allowing enthusiasts to maintain and enjoy their cars.

3. Increased Value

Classic cars often increase in value over time, and the reduced tax rate can make them a more attractive investment.

Additional Considerations

When managing classic car tax, it’s important to keep the following in mind:

Insurance

Ensure that your classic car is adequately insured. Classic car insurance can offer specialised coverage tailored to the unique needs of vintage vehicles.

Maintenance

Regular maintenance is crucial for classic cars. Keeping your vehicle in good condition helps preserve its value and ensures that it remains roadworthy.

How to Change the Tax Class of Your Vehicle

If your vehicle qualifies for classic car tax but is not currently registered as such, you need to change its tax class. This process is straightforward but requires careful attention to detail. Follow these steps to update your vehicle’s tax class:

1. Obtain the Required Form

You can get the necessary form (RF111) from your local Motor Tax Office or download it from their official website.

2. Complete the Form

Fill out the form with details about your vehicle. Make sure to provide accurate information to avoid any delays in processing.

3. Submit Your Registration Book

Include your vehicle’s registration book/log book with the application form. This document proves ownership and is essential for processing your request.

4. Send the Form

Submit the completed form and registration book to the Motor Tax Office. You can usually do this by post or in person at your local office.

5. Wait for Confirmation

Once your application is processed, you will receive confirmation of your new tax status. Ensure that you update your tax records accordingly.

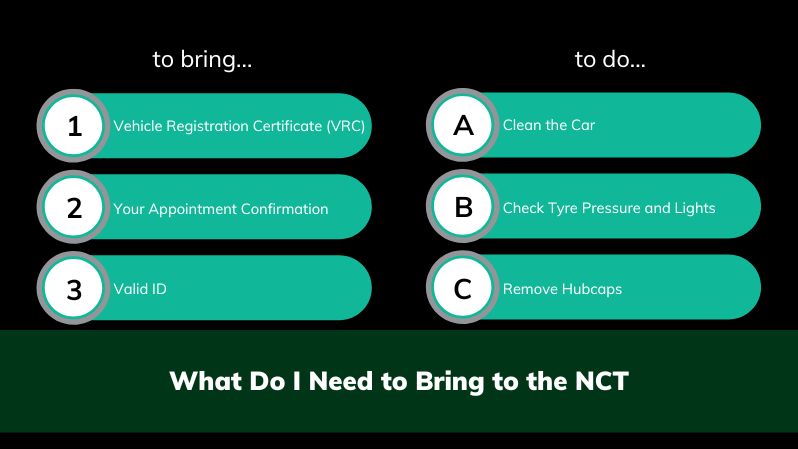

How to Tax Your Classic Car Online in Ireland

Taxing your car online is a convenient option that saves time and effort. Here’s a step-by-step guide to help you through the process:

1. Visit the Online Motor Tax Service

Go to the official government website dedicated to motor tax services.

2. Log In

To use the online service, you’ll need your vehicle registration number and pin. Your pin is usually sent to you via letter or email along with your renewal notice. Log in to access the tax portal.

3. Enter Vehicle Details

Provide the required details about your vehicle, including registration number and personal information.

4. Select the Tax Rate

As long as you have updated your tax status, you should be able to choose the classic car tax option. This is set at €56 per year for eligible vehicles.

5. Make the Payment

Complete the payment process online using your preferred payment method. Ensure that all details are accurate to avoid any issues.

6. Receive Confirmation

After payment, you will receive a confirmation of your tax renewal and disc for display on your car’s windscreen. Keep this confirmation for your records.

Classic Tax vs. Standard Road Tax in Ireland

Understanding the difference between vintage road tax and standard road tax in Ireland can help you appreciate the benefits of owning a classic vehicle. Classic tax is designed to support the preservation of historical vehicles by offering a reduced rate. In contrast, standard road tax rates are based on various factors such as engine size and CO2 emissions, which can lead to higher costs for newer vehicles. To learn more about standard car tax, visit our blog.

Vintage road tax in Ireland offers a flat rate of €56 per year, which is significantly lower than the rates applied to standard cars. This reduced rate is a key benefit for classic car owners and helps to promote the upkeep of valuable historical vehicles.

Navigating vintage road tax in Ireland can seem complex, but understanding the basics can help you make the most of the available benefits. With a reduced tax rate of €56 per year, classic car tax offers a cost-effective way to enjoy and maintain your vintage vehicle. Ensure that you follow the proper steps to change your vehicle’s tax class and take advantage of online services for convenience. For more information on classic car insurance and to get the best coverage for your vintage ride, visit InsureMyCars.ie today.